In this post we will discuss how to set up and calculate the withholding tax in Dynamics AX. Withholding tax is due on non-inventory deliveries (services), that a supplier delivers.

Buyer is legally responsible for paying withholding tax therefore The buyer is responsible for withholding a certain percentage of the invoice amount at the time of payment. (Net amount = invoice amount - withholding tax) is paid to the supplier.

The tax withheld posts to a ledger account for withholding tax, and periodically is paid to the TAX authorities.

To to set up withholding tax perform the following steps:

1- Go To General Ledger > Setup > Withholding tax > Withholding tax codes. Click New, Enter Enter withholding tax codes and Description, Select the withholding main account (withholding Is a liability therefore only balance sheet accounts or liability accounts are valid accounts for posting withholding tax). click Values.

2- Enter The Tax percentage. Close the form

3- Go To General Ledger > Setup > Withholding tax > Withholding tax Groups. Click New Enter withholding tax group name. Click Add in the setup tab to attach the relevant withholding tax code that we created in step 1.

4- Go To Accounts Payable > Common > Vendors > Select vendor then click Edit > Go to Invoice and delivery Tab select the Calculate

withholding tax check box and a Withholding tax group to activate the calculation when a payment is entered in a journal for this Vendor.

6- Go To Accounts Payable > Journals > Invoices > Invoice Journal > Create Invoice journal, select the vendor account that is set up to calculate withholding tax. for the purpose of this example i will create 1000 USD invoice journal, post the invoice.

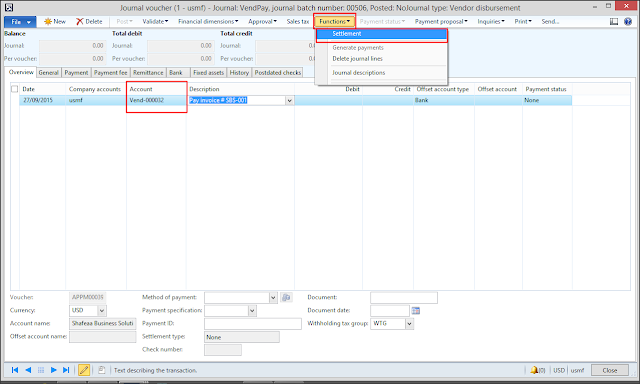

7-To Calculate and post withholding tax in the payment journal go to Accounts Payable > Journals > payments > payment journal. Create new payment select the vendor account that is set up to calculate withholding tax. Click Functions > Settlement.

8- Select the invoice which we had created in step 6. Verify the Infolog information about the calculated withholding tax and close the Infolog. Then Close the form.

10- The payment amount on the journal line is reduced by the withholding tax amount (Net Amount = 1000 - 100 ).

11- Post.

12- Click Inquiry > Voucher. to Verify the Voucher information about the calculated withholding tax. Click Related Voucher then click Voucher.

13- Note that Withholding tax was posted to the main account that we set up in step 1.

Regards.

nice article and good explanation skills

ReplyDeleteHey I’m Martin Reed,if you are ready to get a loan contact.Mr Benjamin via email: lfdsloans@lemeridianfds.com,WhatsApp:+1 989-394-3740 I’m giving credit to Le_Meridian Funding Service .They grant me the sum 2,000,000.00 Euro. within 5 working days. Le_Meridian Funding Service is a group investors into pure loan and debt financing at the returns of 1.9% to pay off your bills or buy a home Or Increase your Business. please I advise everyone out there who are in need of loan and can be reliable, trusted and capable of repaying back at the due time of funds.

ReplyDeleteThanks for sharing Information. it will help to gain knowledge. Especia Associates provide Withholding tax Services . Withholding tax is a quantity of which deduction takes area at once from the incomes of a worker through the employer. It is paid to the authorities as part of the tax legal responsibility of a man or woman. if you need Withholding tax Services call at 9310165114 or visit us Withholding tax Services

ReplyDeleteDiscover top-notch accountant services in Surat to streamline your financial management needs. Our team of skilled and experienced accountants is dedicated to helping businesses and individuals in Surat navigate the complexities of finance, taxation, and accounting with precision and expertise.

ReplyDelete