This Article discuss Payments in advance ( prepayment ) from a customer. This article divided into three parts

- Introduction

- Setup (Step by step with screenshots )

- Implementation (Step by step with screenshots )

Introduction:

Accounting practices in many countries/regions require that prepayment journal vouchers, or payments in advance, from a customer or to a vendor not be posted to the usual summary accounts for the customer or vendor. Instead, these prepayment journal vouchers must be posted to special ledger accounts for prepayment journal vouchers. When a sales order or purchase order is made, an invoice is issued to the customer or vendor. When the invoice is paid, the prepayment journal voucher and sales tax prepayment journal voucher on the ledger accounts for the prepayment journal vouchers are reversed. The invoice amounts are then automatically posted to the usual summary accounts.

Setup:

Setup:

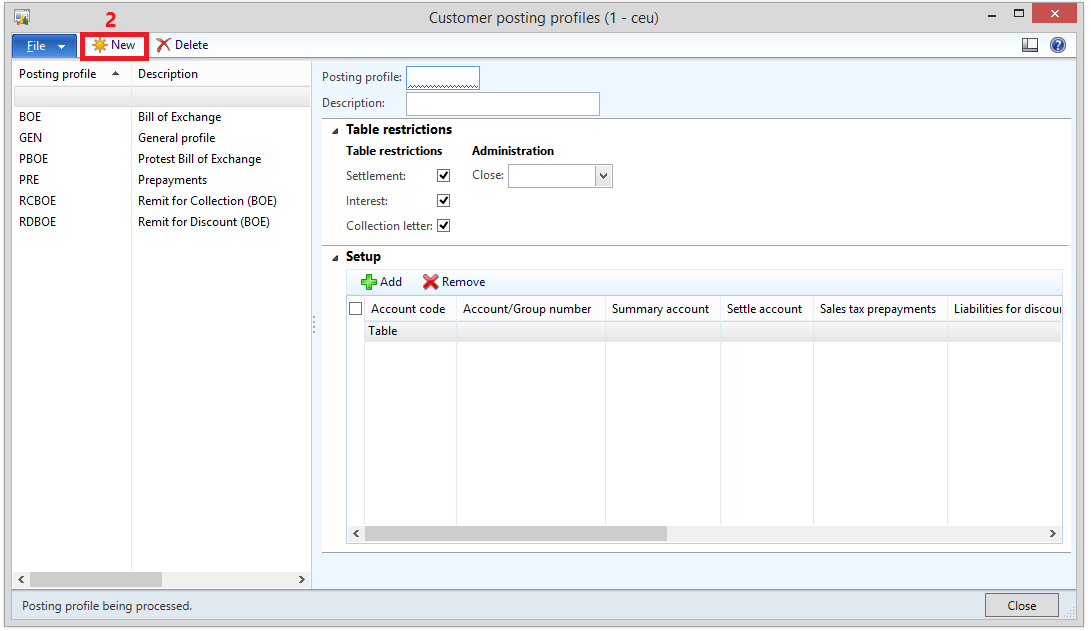

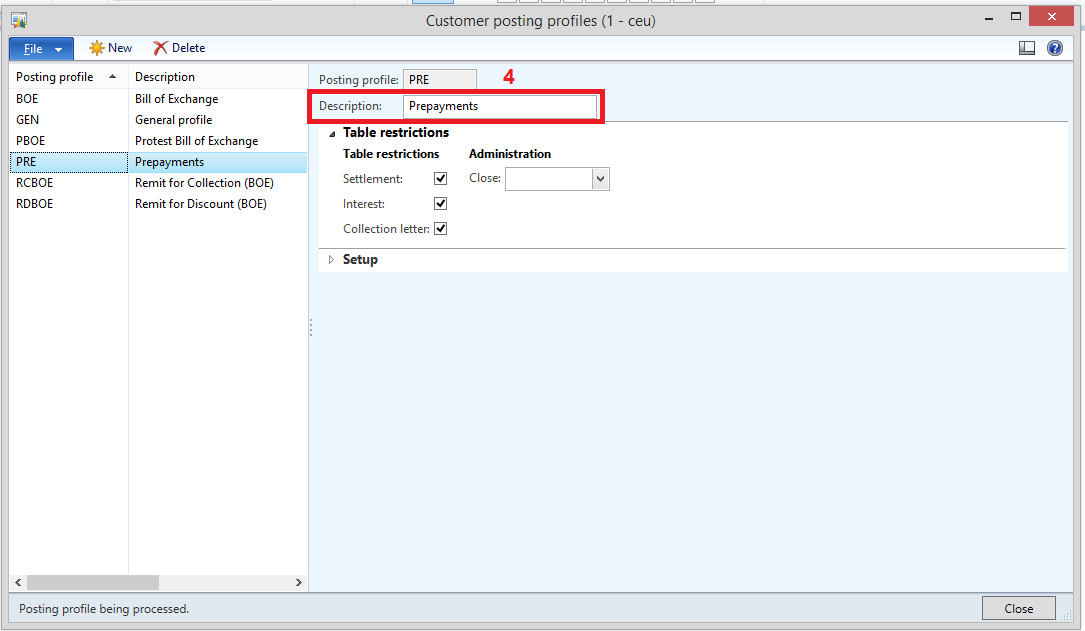

- Create Prepayment Posting Profile

- Setup Account Receivable parameters to use prepayment posting profile

- Create a prepayment journal voucher

- Create a journal.

- On the Setup tab, select the Amounts include sales tax check box if you want to post the prepayment journal voucher together with sales tax amounts.

- Click Lines, and then create the payment line.

- On the Payment tab, select the Prepayment journal voucher check box. The posting profile changes automatically to the posting profile for the prepayment journal voucher.

- Post the prepayment journal voucher.

- Settle Customer invoice with the prepayment.

- In the Settle open transactions form, settle the invoice with the prepayment journal voucher

To get new posts and updates, please follow the blog by clicking the Join this site Button in the top-right side under my personal information

بارك الله فيك خونا

ReplyDeleteوفيك بارك الله

Deletethanks for you

ReplyDeleteinvoice came net without prepayment or with prepayment